This is happening here! Red flag, “Short sale your home with no sign in the yard and not putting the listing in the MLS”.

Not only is this exposing the sellers to potential legal issues down the road it is also putting them at higher rates of foreclosure. If the “investor buyer” can not get the home at the discounted amount and don’t pull their offer the sellers can be stuck and forced to foreclose because they simply ran out of time.

Don’t get caught in this scam as tempting as it may seem. Call today to have this your short sale taken care of “the right way” and get this behind you.

Thanks,

http://www.MrNoHassle@gmail.com 208-941-5629

MSN Article by

By Melinda Fulmer of MSN Real Estate

Real-estate agent Lynne Wright thought she had found the perfect home for her clients. The quiet house on a cul-de-sac in one of the most prestigious gated communities in Bakersfield, Calif., was offered in a short sale for $40,000 less than similar homes on the market.

Wright and the couple moved quickly and made an offer higher than the asking price, but were outmaneuvered by a husband-and-wife real-estate team in Wright’s brokerage office who wanted to buy it for their own use. She didn’t think much of it, until she saw that the property sold for $40,000 less than the $342,000 her clients had offered.

When she asked the listing agent why, she was told to “leave it alone.”

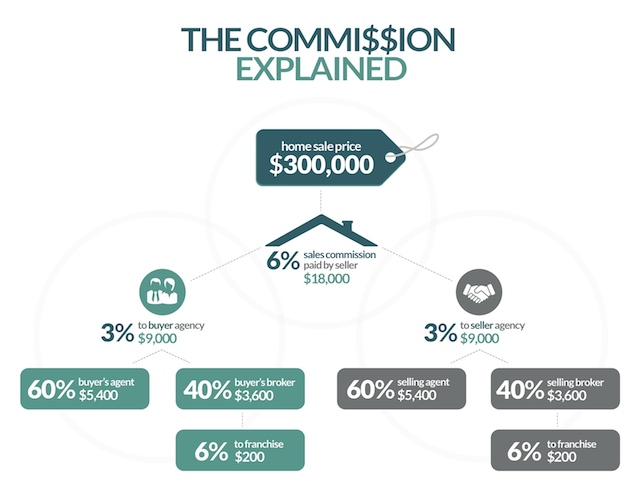

Wright says she is still not sure if the servicer or owner of the property ever saw her clients’ much higher offer. All she knows is that two agents picked up a luxury property for $80,000 less than market value, the banks took a big loss and the listing agent got both sides of the commission, representing his colleagues.

“It’s just robbery,” she says. “And I don’t know how to stop the robbery.”

Apparently the nation’s mortgage servicers don’t, either. Suspicious real-estate transactions have surged in the past two years, analysts say, along with the number of short sales, in which a house is sold for less than the amount of its remaining mortgage.

Short sales are supposed to be “arms length” transactions without any relationship or collusion among the parties, all of whom must sign affidavits to that effect. But the parties often are connected.

Many times, this fraud is committed through limited-liability companies to make it hard for servicers to see who is buying the property, says Robert Hagberg, associate director of mortgage-fraud investigations for Freddie Mac.

In some cases, this type of mortgage fraud involves buyers scooping up distressed properties for a portion of their value, either for themselves or to give back to a friend or relative.

The rest involve “flopping,” where an investor – with the help of an agent or middleman – persuades the bank to agree to a much steeper discount than it should, and immediately resells the property to another buyer for a significant profit without having made any improvements. The FBI says it has found numerous instances in which organized-crime groups were involved in short-sale fraud.

According to a recent study by CoreLogic, short sales that were resold the same day averaged a 34% gain (or $54,947) between sale prices.

One in every 52 short-sale transactions in the first half of last year appeared to be one of these “suspicious” resales, CoreLogic said. This year, it expects lenders, servicers and investors to incur more than $375 million in unnecessary losses from these shady deals, as the number of short sales surges an additional 25%.

“Short-sale fraud and other servicing-related fraud is definitely the fraud du jour and our greatest area of focus at the moment,” Hagberg says. In 2011, more than 50% of Freddie Mac’s investigations were related to short sales.

Who are the perpetrators?

For the most part, these deals involve insiders, from the underwater borrowers themselves to investors, listing agents, brokers providing valuations and so-called “facilitators,” or middlemen negotiating with the banks and buyers trying to flip the properties.

Banks, with a huge backlog of distressed properties, are under pressure to do a lot of transactions and to do them as quickly as possible, says Ann Fulmer (no relation to the reporter), vice president of industry relations for Interthinx, a company that helps lenders reduce their fraud risk.

Knowing this, these insiders are able to work the system and push through bogus valuations to set the price of the sale or fend off higher offers.

Fulmer has seen listing agents involved in these scams post properties in multiple-listing services in the wrong city to avoid competition. Some post pictures of a completely different, junk-filled property. Or they stipulate that only people from the real-estate office will take offers on the property, so they can control the transaction.

In Wright’s case, which was reported to the state but has not been prosecuted, real-estate agents controlled every aspect of the deal. An agent in her office was the distressed borrower; the listing agent who represented the property and buyer sat just desks away, as did the real-estate team who eventually wound up with their own luxury property for a song.

“The thing that really bothered me was the lack of ethics,” Wright says. “Sure I can find my clients another house; what I couldn’t explain to them very well was how (something like this) can happen.”

Gary Crabtree, an appraiser in the area, said he got calls from several agents whose offers were rebuffed for the rock-bottom inside bid.

“It set an all-time low for that neighborhood,” he says

Link to article http://realestate.msn.com/more-short-sales-bring-new-scam-flopping?page=2

You must be logged in to post a comment.